Us Election Momentum: Will Bitcoin Hit $80K In A Week?

The US election results and Fed rate cuts have sparked new optimism in the crypto market, with Bitcoin surging by 12.78% since November 5. Analysts predict BTC could hit $80,000 within days as investors show renewed confidence.

The recent US election and Federal Reserve interest rate cuts have provided a notable boost to the crypto market, particularly impacting Bitcoin. Since November 5, Bitcoin has gained 12.78%, with analysts suggesting it could surge to the $80,000 mark in the coming week. A crypto analyst shared this bullish forecast on X, indicating that the renewed interest could propel Bitcoin to new highs in the short term.

This is why #Bitcoin goes so much higher from here and I see 80k next week.

— James Van Straten (@btcjvs) November 8, 2024

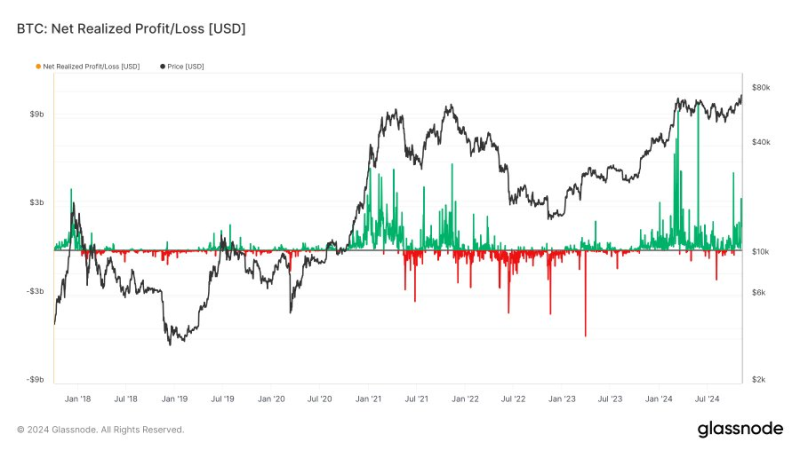

Very little realized profit being taken compared to previous ATHs.

BTC is below the inflation adjusted ATH, its consolidated for 9 months, investors want more.

What is wild, we are seeing less… pic.twitter.com/PXRwExAft9

Over the past month, Bitcoin has grown by an impressive 25.9%. This gain comes amid a trend of low profit-taking, which signals strong investor confidence. Typically, when prices reach perceived highs, investors cash out to lock in profits. However, current data from the Bitcoin Net Realized Profit/Loss chart reveals that profit-taking activity remains relatively low, suggesting that investors anticipate further gains.

Over the past month, Bitcoin has grown by an impressive 25.9%. This gain comes amid a trend of low profit-taking, which signals strong investor confidence. Typically, when prices reach perceived highs, investors cash out to lock in profits. However, current data from the Bitcoin Net Realized Profit/Loss chart reveals that profit-taking activity remains relatively low, suggesting that investors anticipate further gains.

The analyst also pointed out that Bitcoin’s current price remains below its inflation-adjusted all-time high (ATH), indicating even greater potential for growth. Additionally, the last nine months of consolidation have provided stability to Bitcoin, strengthening its base and potentially setting the stage for a sustained bullish run.

Bitcoin’s Market Performance Overview:

In the second year of Bitcoin’s typical four-year cycle, the market generally shows weaker performance. For instance, Bitcoin posted a return of +183.5% in 2012 and +123.8% in 2016. Despite mixed performance in the first three quarters of 2024, Q4 has historically been a strong period for Bitcoin. Last quarter, BTC returned +56.6%, while current momentum hints at continued growth.

From a low of $67,821.68 on November 4, Bitcoin has now seen a 12.78% increase. With Van Straten’s prediction and current market dynamics, $80,000 could be a realistic short-term goal for Bitcoin.

Online advertising service 1lx.online

¡Nuestro creador crea increíbles colecciones de NFT!

Apoya a las editoras - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Binance Free $100 (Exclusivo): usa este enlace para registrarte y obtener $100 gratis y un 10% de descuento en las tarifas de Binance Futures del primer mes (Términos y condiciones).

Bitget - Utilice este enlace Utilice el Centro de recompensas y gane hasta 5027 USDT. (Revisión)

Registro en el exchange Bybit: Utilice este enlace (todos los posibles descuentos en comisiones y bonificaciones hasta $30,030 incluidos) Si se registra a través de la aplicación, entonces al momento del registro simplemente ingrese en el campo de referencia: WB8XZ4 - (manual)

Fuente – Traducido y publicado ✓